Statement No: 1 Issue No. : 524, Issue Date :December 06, 2023 Grameen Bank Monthly Update in USD: November, 2023 Sl. No Particulars In million…

Human Resource Management (HRM) is the strategic approach to managing an organization’s workforce or human resources. It involves overseeing all aspects of the employment lifecycle,…

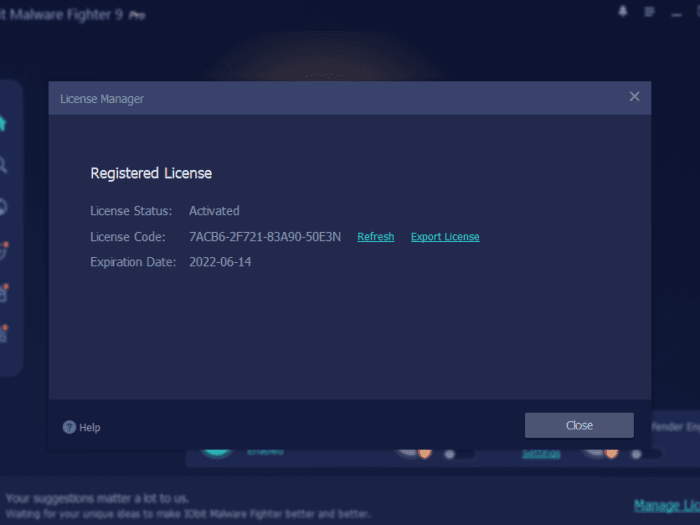

IObit Malware Fighter is a powerful and comprehensive anti-malware and anti-virus program that can protect your PC against the latest spyware, adware, ransomware, Trojans, keyloggers,…

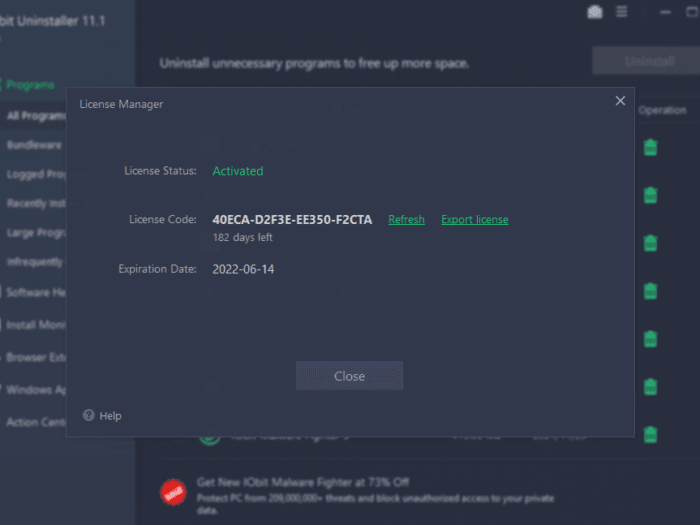

IObit Uninstaller is a perfect uninstall tool. It provides an easy and secure way to remove unwanted programs thoroughly, Windows Apps, Universal Windows Platform (UWP)…

After a series of preview versions, Microsoft finally came out with an official version of Office 2019. It is stable one, this means you can…

Microsoft Office 2013 is a version of Microsoft Office, a productivity suite for Microsoft Windows. It is the successor to Microsoft Office 2010 and the…

Microsoft Office 2016 is a version of the Microsoft Office productivity suite, succeeding both Office 2013 and Office for Mac 2011, and preceding Office 2019…

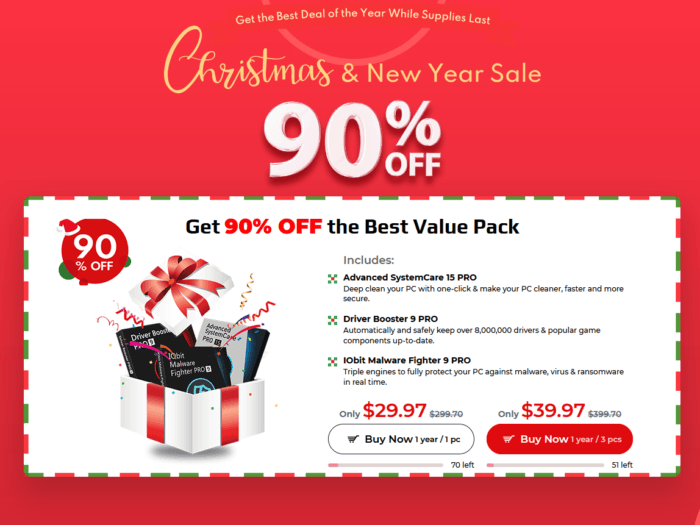

Do you want to find iobit discount coupon code? You can find it here. You can buy Driver Booster 9 Pro license key (1 year,…

What is a youtube to mp3 converter? Downloading audio from a video posted on YouTube can be useful in a wide variety of situations. Now,…

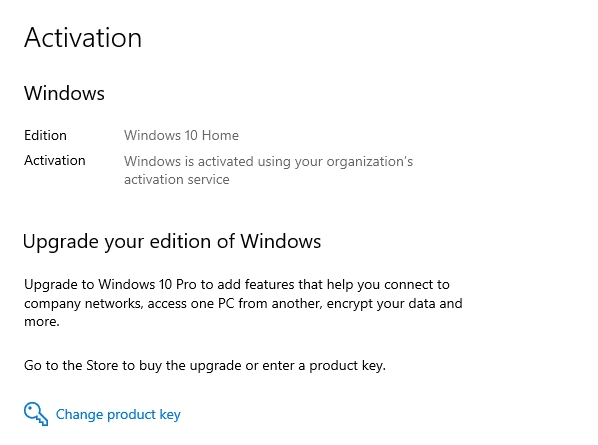

Windows 10 has now become the world’s most popular operating system with 400 million users. Windows 10 was released on July 29, 2015, and it…